Wondering what makes you encounter Zelle Unable to Process Payment issue and how to get out of it? Don’t worry, we’ll help you get the answer in this article.

What Can You Do When “Zelle Unable to Process Payment?”

Facing “Zelle Unable to Process Payment” can correspond to a number of conditions. The most common being a situation when the concerned recipient hasn’t enrolled to use Zelle services. Apart from that, expired cards, incorrect details, server issues are other prominent factors. The best thing you can do is figure out the exact problem and act according to that.

Zelle’s presence in major banks in the US means we trust the payment service to offer fast transactions when we’re on the go. A lot of us forego other payment apps because of it. So, a Zelle unable to process payment situation always stumps us.

What could be the matter? Is it a problem with your bank? Is the problem on Zelle’s end? What if the recipient is the one who has to sort things out? There are steps you can take to determine the cause and solve it.

Reasons why Zelle is Unable to Process Payment and Possible Solutions

Suppose you are unable to process transactions on Zelle, both on the sending and also on the receiving end. In that case, multiple factors could be causing this error. Let’s look at each of them one-by-one.

1. Recipient Is Not Enrolled Yet

This shouldn’t show up as a Zelle unable to process payment situation. Instead, you should see a pending status on the payment you sent.

If that’s the case:

- Ask your receiver to find the payment text from Zelle.

- Click on the link and enroll with a phone or email address.

- Verify their bank account, debit, or credit card.

The payment should reach them within 3 days of enrollment.

If your recipient doesn’t live in the US, they won’t receive the payment. Zelle only allows transactions inside the U.S. You should either receive an unable to process transaction text from Zelle or have the amount credited back to your account in a couple of days.

2. Incorrect Phone or Email Address

Your recipient’s phone or email address might not be linked to their bank account. If so, their enrollment isn’t valid, and as such. Ask your recipient to correct their information and turn on the notification service.

Your payment won’t go through if there is a single mistake in a digit or letter.

- Open your bank’s mobile app.

- Find pay services on the app.

- Usually, there is something called QuickPay with Zelle.

- Click on Send Money.

- Tap on Add and then either fill in your recipient’s email or mobile phone number.

- Check the information you entire.

- Choose the add recipient option, type in the balance, and where you want the payment to be processed from.

- Select ‘Send Money’.

- It will ask you to confirm once more. After confirming press Send Money.

3. Expired Credit Card

If your credit card has expired, your payment is unlikely to go through. Your bank will no longer serve you via this method. This is an easy fix, though.

- Contact your bank.

- Ask them the date your credit card will expire.

- If it has already expired, ask your bank to forward the details on how to renew your credit card.

- Get the paperwork rolling as soon as possible if there’s some time left.

4. Problems With the Debit Card

Zelle has an extremely fast transfer service. It takes minutes at most for an amount to be deposited into your account, especially if both the sender and the receiver have completed their enrollment.

For this, Zelle only accepts debit cards with a fast transaction system. If you have a Zelle unable to process payment problem, it could be because the debit card on the receiver’s end isn’t the one supported by Zelle.

This isn’t one you need to worry about. Turn on the settings to deposit the money directly into the bank account rather than via debit details.

Banks understand how vital Zelle can be for on-the-go payment. As such, they have been creating debit cards that enable fast processing.

5. Wrong Zip Code

Zip code is one of the essential pieces of information Zelle uses for processing payment. So, if the zip code on your bank information is different from the one you used to enroll on Zelle, payment issues are inevitable.

If you are uncertain about your zip code, contact your bank to confirm which one it is or get a post office website.

Other information that stops Zelle from processing payment if it doesn’t match the bank:

- Wrong name from the one you used on your debit card.

- Wrong CVV number.

- Expiration date.

- Wrong address or city listed.

6. Invalid CVV

Similar to the expired credit card issue, a wrong digit for the CVV could make you face unable to process transactions Zelle message. CVV is one of the key factors that help payment services determine your authority on the card and your identity.

7. Perform Server Check

Server downtimes can often lead to transaction-related issues, and unable to process transaction on Zelle is no exception. Having said that, employ a couple of minutes and verify if you really need to think about manual fixes, or just waiting around will help serve the purpose.

- Launch the web browser on your smartphone or PC

- Head over to Downdetector

- Input Zelle on the dedicated field and initiate a search.

- Study the graph and understand the working status of Zelle

Does everything look fine? Well then, try moving ahead with the fixes as mentioned below.

8. Contact Customer Support

There is nothing wrong with your information or your recipient. Sometimes, the error is entirely on Zelle’s end. The entire transaction could’ve been hampered because Zelle’s facing some technical issue.

You can confirm whether that is the case by contacting Zelle’s customer support.

- If you need immediate assistance, you can contact them at 1-844-428-8542.

- Otherwise, fill up their customer service form with your details and a description of the issue.

Zelle promises to call you within 2 days of your submission unless there is a public holiday in between.

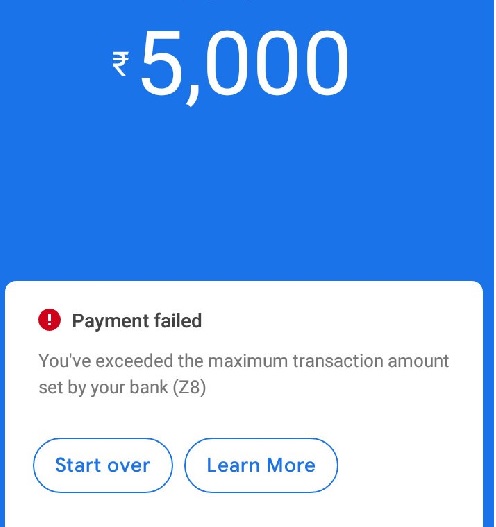

9. Exceeding Transaction Limits

The transfer amount exceeding the bank’s Zelle restrictions is a frequent cause. As there are typically no caps for receiving on Zelle, this issue should arise at the sender’s end.

Banks typically establish their own monthly or daily limits for Zelle money transfers. Below are some examples for banks:

- Bank of America – $2,500 per day

- U.S. Bank –$2,500 per day

- TD Bank – $1,000 per day

- Wells Fargo – $2,500 per day

- Capital One – $2,000 per day

- Truist – $2,000 per day

- PNC Bank –$1,000 per day

- Ally- $500 per day

10. Restricted Account

There have been some devastating scams recently if you’ve been keeping up with the fintech industry news. Some of them involved Zelle.

The payment service has strict rules meant to deter scammers. As such, they are known to quickly restrict accounts whenever they notice any kind of unusual activities on an account. Unfortunately, some deals still go through. It gives Zelle every reason to be cautious.

To not get mistaken for fraud by Zelle, it would be beneficial if you read the terms of services thoroughly.

Some of the reasons Zelle could restrict your account:

- They believe you have been using Zelle to conduct your business. Zelle is supposed to be only for personal use, so they tend to suspend business accounts.

- If you are not using it for business, this misunderstanding could be because you had multiple payments coming-in frequently, making it look like transactions on a store.

- After enrollment, Zelle asks for your email, phone, some other identity document from time to time. If you fail to provide those and Zelle sends the request several times, they will temporarily restrict your account. Once you hand over the information they need, your account will be active again.

- If Zelle has reasons to suspect you might be involved in some fraudulent activities or actively trying to scam someone, they will restrict your account.

- In addition to scams, if Zelle sees you are using your account in a way that could harm both Zelle’s and other financial institutions that are part of their network, they will suspend you to prevent further damage.

Some of the other user agreements that you could have violated:

- You are not 18. Zelle needs you to be 18 to allow you to use their services. You shouldn’t have been able to enroll if you aren’t 18. However, if you have, they will suspend your account immediately.

- You do not have authority over the debit or credit card you have linked to the account.

- You have more than one profile. While Zelle doesn’t have an issue with several profiles, they do ask you to link different phone numbers and emails for each bank you use.

11. Suspended Account

Your Zelle account is facing suspension for the same reason it got restricted. The restriction is the first step for Zelle. This is the period they thoroughly check your account and see if you are in violation of their terms. Finding you to be guilty, your account will get suspended in a matter of time.

Now again, when you believe you are facing unjust suspension from them, you can contact their customer service. While we would like to tell you this will resolve the issue, lots of reports online suggest otherwise.

FAQs: Zelle Unable to Process Payment

Why did Zelle restrict my account?

The primary reason Zelle restricts accounts is when they have reasons to believe you are engaging in suspicious activities. However, it’s impossible to know the reason until you contact their customer support team.

Why is Zelle taking 3 days to process payment?

If you created a brand-new Zelle account, the first payment you send could take anywhere between 1 and 3 business days to reach the recipient. A payment sent to you for the first time can also take 3 days. This is a security measure by Zelle to verify your identity before they allow transactions.

What is the error A101 on Zelle?

The A101 error shows up when Zelle finds your device to be untrustworthy for login. Zelle only allows login from mobile data, so if you’re using WiFi, it’s unable to check your phone number. This error could also show up if you try login in using a phone with a different number than the one verified with Zelle.

Wrapping Up

Most of the time, ‘Zelle unable to process payment’ situations have an easy fix. Unless Zelle decides to restrict your account for some abstract reason, you can try and find out the reason, but most complaints from customers suggest this issue is rarely solved. It might be better to move on to another payment processing app that has a seamless connection with American banks like Zelle.

Further reading:

Similar Posts:

- How to Cancel Zelle Pending Review: Quick Easy Steps

- Why Won’t my Zelle Payment go Through?

- [Answered] How Long Does Zelle Pending Review Take

- Does Zelle Work After Business Hours?

- [Fixed] Zelle Payment Funded but Not Received