Are you one of those who wonder Why Won’t Chime Accept my Check at all? Here’s everything you need to know.

Due to Chime’s nature of being completely online, even check deposits have to be done over the mobile application. While usually a smooth process, you do have situations where you wonder why won’t chime accept my check? Especially if this is your first time depositing a check with Chime, it’s not impossible to run into problems.

So, let’s check out the perfect way to deposit a check with Chime.

Why Won’t Chime Accept My Check at All?

We have to consider several possibilities for why you’re in a why won’t Chime accept my Check situation. Most of these are easily fixable, while others will require patience on your part.

1. Chime Is Down

If you have followed the Chime mobile check deposit procedure closely and yet, the cash doesn’t seem to be anywhere near your account, Chime servers could be down.

Chime has a rough estimate of about 13 million monthly users. Can you imagine the number of online transactions the fintech company has to automate on top of check deposits? It’s not impossible for the servers to crash now and then.

Of course, they do all kinds of maintenance to keep up with the ongoing traffic, but sometimes, it doesn’t work. Sometimes, maintenance work itself could lead to the temporary freezing of the app. You can always check whether Chime is working for everyone in the US by going to Downdetector for crash reports.

2. Passed the Daily Deposit Limit

All bank services have a daily and monthly deposit limit. For Chime, you cannot deposit more than $1,000 a day. By day, we mean every 24-hour gap.

You can’t deposit more than 3 times a day either. So, if you have surpassed any of these limits, you should wait for 24 hours before giving it another try.

3. Passed the Monthly Limit

All banking services pass a monthly deposit limit to lower the chances of fraudulence. For Chime, it is a limit of $10,000 per month. Think about the number of cash deposits you had this month. Did you go over the limit? If so, the check deposit won’t be accepted.

If you need more than $10,000 a month, you can contact Chime’s customer support. They will show you the process of increasing your monthly limit.

4. Lack of Clear Image

You are doing transactions over the internet. While the deposits are processed as soon as you submit them, it is done by AIs. The image uploaded must be crystal clear, preferably high quality, for Chime to determine it to be a legit check.

It can’t be a blurred image at all. Every line on the check should be easy to see. Zoom in on the picture to determine whether you took a good picture. Do the letters blur when you zoom in or are they still clear? If they are still clear, the picture should be acceptable for Chime.

5. Not Signed

A surprisingly basic mistake you could have made is not signing the check. For check deposits to go through, Chime needs to determine your signature is authentic. If you don’t place your signature, they have no way of knowing if it is you.

This is the rule for depositing any kind of check-in in general. So, take a good look at your check and verify you have signed it.

6. Only Captured One Side

Chime needs information on both sides of the check to process your deposit. So, if you somehow only captured the front side and uploaded it, Chime’s verification process won’t work. Take pictures of both sides and try uploading the check. See if your deposit goes through.

How Long Does a Mobile Check Deposit Take With Chime?

Once you have uploaded a picture of your check, you’ll wonder how long it takes. Is chime mobile check deposit instant? What if you thought Chime isn’t accepting your check when it’s just taking some days for the amount to hit your account?

You can get an idea of how long your mobile check deposit will take on the app. Once you go through the deposit process, Chime will show you the pending check. Additionally, they will give you an estimate of when the check will hit your Chime bank.

Usually, it barely takes a day before Chime processes your check and adds funds to your account. However, if it’s a check with a huge amount or a personal check, it can take 3 days.

Chime also doesn’t process checks on national holidays. So, if you submit any check on a holiday or the day before a holiday, you will receive the deposit the day after.

The deposits don’t enter on Saturday and Sunday either.

When the check is pending, the color will be gray for the amount. When the funds are finally available, the color turns green.

Not every Chime customer can use the mobile check deposit feature either. You can only make mobile deposits if Chime is your primary bank.

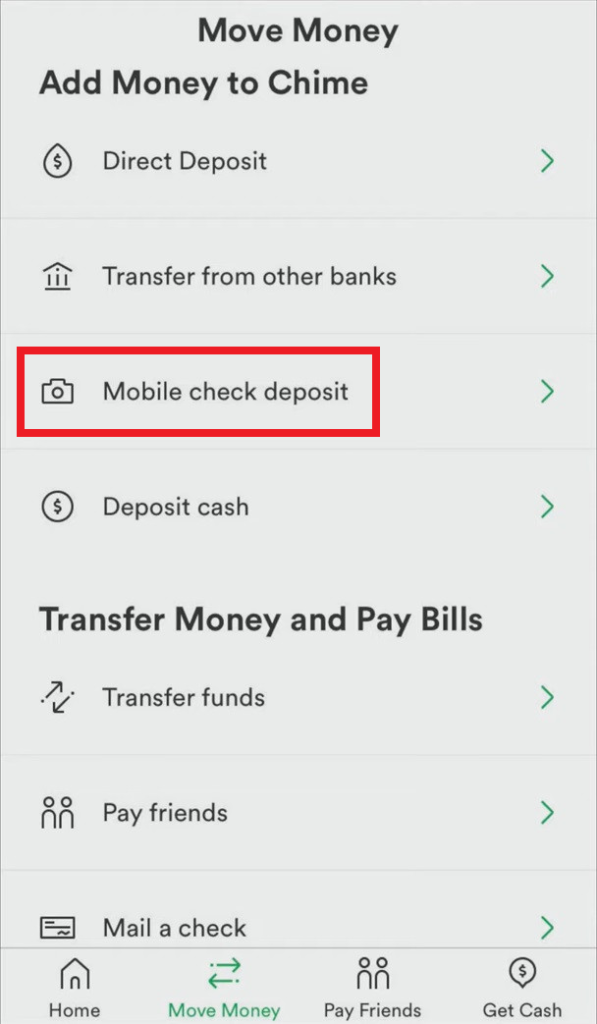

It would help if you had direct deposit enabled and a debit card that you regularly use. Verifying the validity of a check online is hard. So, this small security measure gives Chime the confidence you are not engaging in any kind of illegal activity on their platform.

How to Do Chime Mobile Check Deposit?

Going through the Chime mobile check deposit process will help you confirm if there has been any mistake in the way you submitted your check.

For one, you should carefully enter the details on the front of the check. Make sure you get nothing wrong. From the account number to your Pincode, every number and letter must be legible. The device should be able to read the check.

The back of the check also has to be signed, and the front where there is a token space. You might also have to add the nature of your deposit to the bank, depending on your Chime account type. It is usually between deposits for mobile or remote deposit capture.

Once these criteria are clear, here are the next steps:

- Open your Chime app.

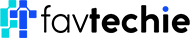

- Select the Move Money option at the bottom of the screen.

- Scroll down to the Add Funds section.

- Look for the Mobile check deposit button.

- Choose the account type you are going to deposit your check into. Whether you want the funds in your savings, account or checking account.

- Use the number keys to enter the amount you are depositing and is stated on the check.

- Click a picture of the check with your phone. Choose a place with good lighting to click the picture to crystal clear every detail.

- Once the image has been uploaded, recheck all the details.

- Tap on Confirm.

It might take 1 to 3 days for the check to clear. At most, it can take a week. Don’t throw the physical check away.

When the funds clear, write ‘void’ on the back of your check and keep it somewhere safe. You might need it later for tax filing and other such financial purposes.

Is Chime Mobile Check Deposit Enabled?

You can’t perform mobile check deposits on Chime if it isn’t enabled. You won’t have the option to do so unless Chime is your primary bank.

These are all information you will need to verify with Chime while creating your account. Generally, you will have to be over 18 and a US citizen. You also need to have a debit card with your Chime account.

If you are sure you meet these criteria, open your Chime app. Go to the Move Money option, and if you see Mobile check deposit underneath, you can deposit your check remotely.

If you want to acknowledge Chime as your main bank and don’t know how to, you should contact their customer support. Their support team number is 1-844-244-6363, and they’re available every day except weekends.

Additionally, Chime needs you to have received a direct deposit once in your life from an employer, government, or someone else in a higher organizational position. So, enabling direct deposits on Chime and receiving even a $1 deposit allows you to make mobile check deposits.

How to Set Up Direct Deposit on Chime?

To enable direct deposit on Chime, you need to gather information on your routing and account number.

- Open Chime App.

- Go to Settings. It is at the top left corner of the app. As you know, always depicted by the gear icon.

- Scroll down to Account information.

- You will find both the account number and routing number.

Now, to manually set up direct deposits on your Chime account:

- Launch the Chime App.

- Tap on the Settings icon.

- Find Account information.

- Look for the Set Up Direct Deposit option and tap on it.

- Select Get direct deposit form.

- A PDF version of the form will instantly be sent to your email.

- Carefully peruse the form.

- When you reach the amount section, you will find options to choose whether you want the entire paycheck deposited or a certain portion of it.

- Choose whichever you prefer and leave your signature at the end.

- For the Authorization section, you have to write the name of the person whose payroll you are on or your employer’s name.

- Send the form to whoever is in charge. It can be HR or your employer.

The same steps apply if you are enabling direct deposit for unemployment benefits.

Once you receive your first $1 from direct deposit, it signals to Chime that you rely on them for all your main banking needs. They can enable the mobile check deposit option at this point.

Frequently Asked Questions (FAQs)

Let’s look through some Chime bank mobile check deposit FAQs to clear any confusion.

1. Why did Chime not accept my mobile check deposit?

While it could be for several reasons, let’s first make sure you have direct deposits set up. The mobile check deposit feature isn’t extended to you if it isn’t set up. You won’t find the mobile check deposit option without enabling direct deposit.

However, if you can deposit checks on the app and Chime isn’t accepting the latest one, make sure you have submitted a clear image with a signature on both sides of the check.

2. Can I deposit a check to my Chime account?

To deposit a check to your Chime account, you have to take a picture of the check and upload it to the Chime app. Chime virtually reads your check and processes it. The check should clear within 1 to 3 days.

If you want to deposit a check in person, while Chime has no physical bank, they do have 90,000 retail connections. Drop by any of these locations and let the register know you want to deposit a check.

3. Can I deposit a check at an ATM with Chime?

You can’t use ATM to deposit checks on Chime. You can go to any of the 90,000 retailers in relation to Chime and deposit a check physically.

Why Won’t Chime Accept My Check: Answered

If you’re facing a why won’t Chime accept my check situation, rest assured, it’s something easily solvable. In most scenarios, it’s a minor mistake with how you uploaded the check. Also, make sure to enable direct deposit before you try dropping any. If any of the workarounds don’t work, calling Chime customer service is your safest option.

Further reading:

Similar Posts:

- What Time Does Chime Direct Deposit Hit On Wednesday [Answered]

- Can I Get My SBA Loan on My Chime Card Right Now?

- Can I Load My Chime Card At Dollar General in 2022?

- Does Quadpay Accept Chime? [Everything You Should Know]

- Does Klarna Accept Chime? Everything you Need to Know